Pullback Candles (Candlestick Analysis) Guaranteed Winners

A valid pullback occurs when the next candle takes out the low of the previous candle, regardless of its color, and this pattern is called an impulse and correction, which helps traders understand market structure and make informed trading decisions. 📈. 03:01. Market making higher highs and impulsive moves, pullbacks are only valid if they.

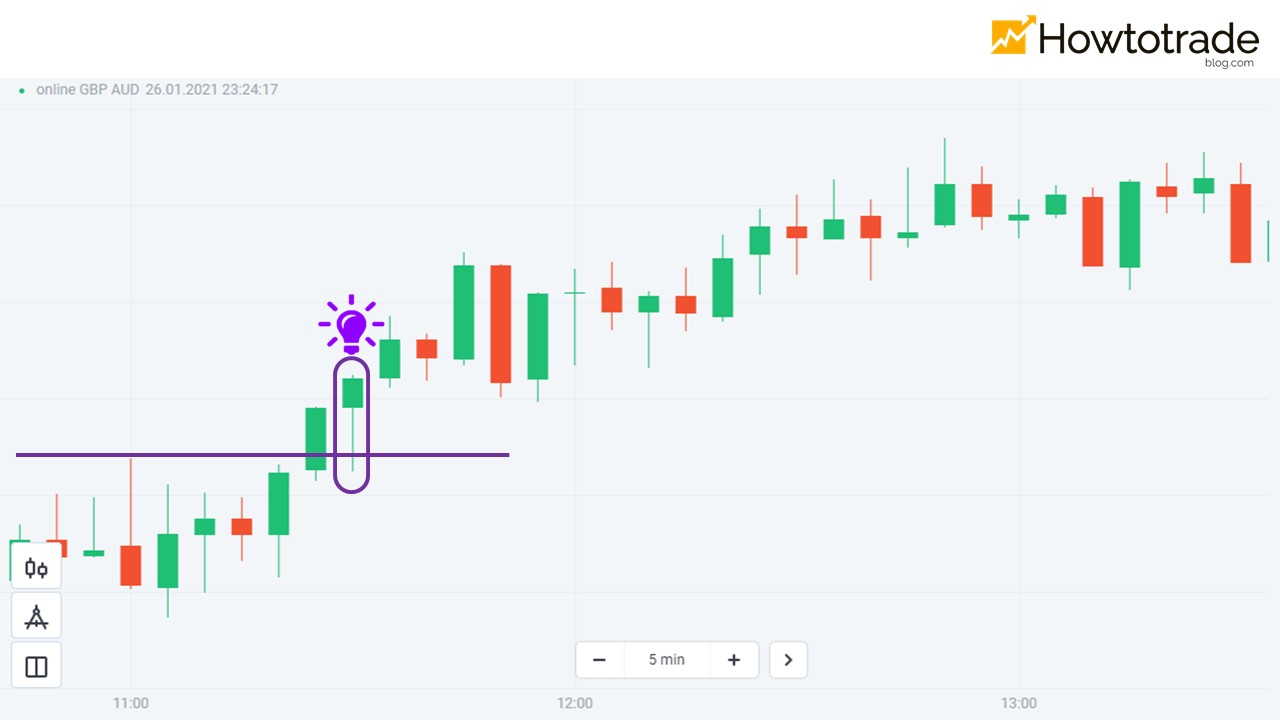

Olymp Trade Trading Strategy With Pullback Candle & Support/Resistance

The third bearish candlestick pattern that traders should look for in a pullback is the Evening Star pattern. This pattern is formed when a bullish candle is followed by a small-bodied candle, and then a bearish candle that closes below the midpoint of the first candle.

How To Find Pullback Trade Zones With HeikenAshi Candlestick Chart

Learn how to use the Heiken-Ashi candlestick chart as a powerful tool to find pullback zones for low-risk entries to take advantage of market trends. Table Of Contents Pullback trading is popular among technical traders due to its simplicity. And you can use Heiken-Ashi candlesticks to make it even simpler.

What is a Pullback & How To Profit From It In Your Trading?

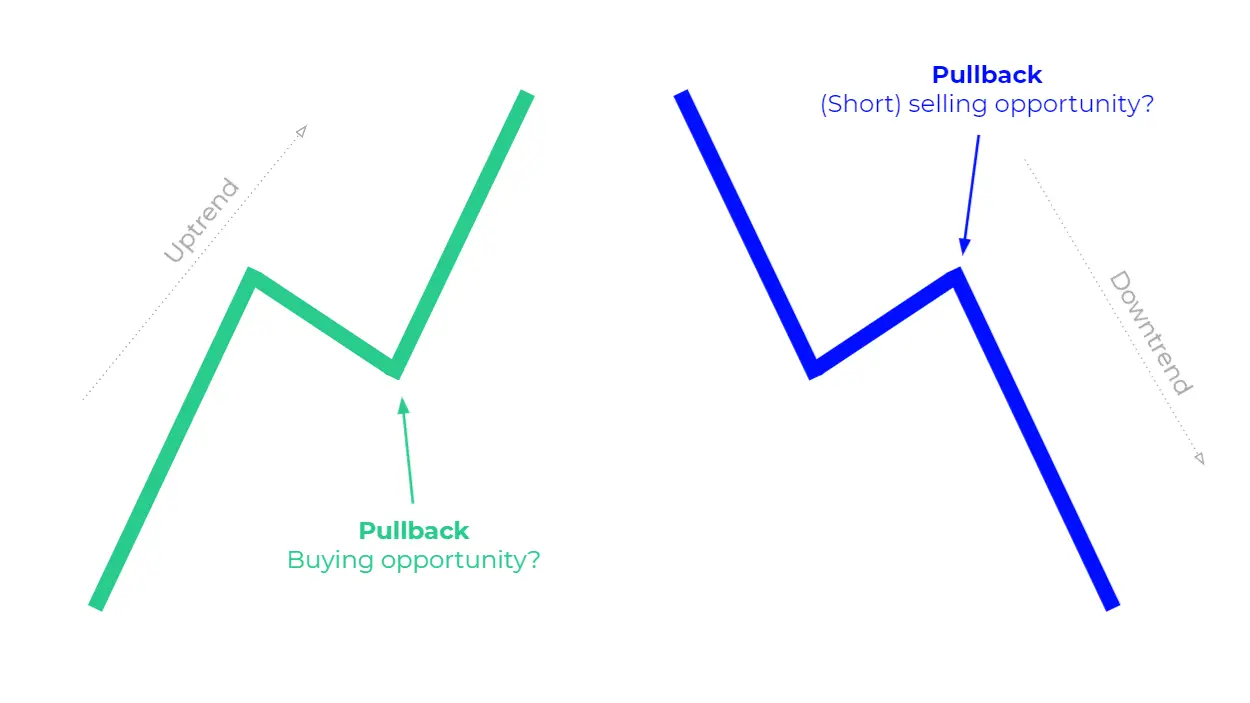

#1: Trade in the direction of the trend The first step to pullback trading is to identify a trend (that's relevant to your timeframe), and then trade in the direction of it. For example, if you're trading the daily timeframe, then you must have a trend on the daily timeframe. Here's what I mean:

How To Trade Blog Olymp Trade Trading Strategy With Pullback Candle

A pullback is a pause or moderate drop in a stock or commodities pricing chart from recent peaks that occur within a continuing uptrend. A pullback is very similar to retracement or.

Learn how to trade a pullback candlestick pattern

PULLBACK CANDLESTICK STRATEGY BY SIMPLE TRADING TECHNIQUES. SimpleTradingTechniques Essential . aud GBP EUR CAD chf jpy NZD USD Oil Stocks. 506. 7. aud gbp eur cad-dollar chf jpy nzd usd oil stocks. Arrow represent trade setup Circle represent triggering of the trade ----- 1. Where to place stop loss? 2. Where to exit the trade?.

Review Pullback Candlestick Trading Strategy On The Real Account

Posted 7:00 a.m. The Emini reversed up from below yesterday's low in the first minute of the day. Although it had several consecutive bull bars, they had prominent tails. This happens more in a bull leg in a trading range than in a bull trend.

How To Trade Blog Olymp Trade Trading Strategy With Pullback Candle

The Pullback Candlestick Strategy is a technique that uses only 2 indicators, comprises 5 simple rules , great for both short and long term moves in the Market that works in any timeframe, Stock, Forex, Cryptocurrency, Index, ETF, Emini & Commodity markets and any direction.

How to trade pullback candlestick with fixed time trades at Olymp Trade

A midday turnaround prints a small Doji candlestick, signaling a reversal, which gathers momentum a few days later, lifting more than two points into a test of the prior high. The stock then.

TYPES OF PULLBACK! Stock trading learning, Trading charts, Forex

Pullback Candle will signal when price is at the end of a pullback and entering a balance phase in the market (works on all markets) Also we can expect a Pullback Candle during flash crashes as the theory of this script is when there is a turning point in momentum - this candle will appear and we can look long from this signal.

The Double Top Strategy The Pullback Trading Entry Technique Pro

Trading A Pullback: Trade Against a Trend A Pullback: Trade Against a Trend Nov 29, 2021 When reading analytical outlooks on price movements, you might run across the word "pullback". Many trading strategies are based on pullback action, and pullbacks allow you to trade against the trend.

Pullback Trading 7 Factors to Consider Before Placing a Trade

The final candle of the formation should open up in the body of the last bearish pullback candle and close above the first big bullish candlestick. If you are familiar with chart patterns, you will notice that this pattern strongly resembles a bullish flag.

Review Pullback Candlestick Trading Strategy On The Real Account

This indiator will help you to find a Pullback + Candlestick Pattern, inspirated by Steven Hart You can combine with your own strategy, or use this purely DISCLAIMER : Measure the risk first before use it in real market Backtest The Strategy was very important, so you know the probability Fundamentally Logical :

How to trade pullback candlestick with fixed time trades at Olymp Trade

In a downswing (impulse wave) of a downtrend, the thrusting pattern is seen as a bearish continuation pattern. On the other hand, if the pattern appears at a support level in a pullback of an uptrend, it can be considered a bullish reversal pattern.

How To Find Pullback Trade Zones With HeikenAshi Candlestick Chart

Strategy #1: Pullback Trading With Trend Lines and Channels If you like the simplicity of price action, this strategy will appeal to you. In this method, you use a trend line to define the significant trend. Then, you draw a channel to identify oversold (overbought) conditions for your entry.

Breakout entry, Pullback entry swing setup examples. Learn Forex

Candlesticks are the foundation of any price action chart. And although I do not recommend to trade candlesticks blindly - because their predictive power is not strong enough - when combining candlesticks with other confluence factors of technical analysis, a trader may improve the odds for determining the right price direction.